BTC Price Prediction: $150K Target in Sight as Technicals and Fundamentals Converge

#BTC

- Technical Breakout: BTC price sustains above 20MA with MACD reversal

- Institutional Adoption: Corporate treasuries and portfolio allocations scaling

- Macro Synergy: Geopolitical tensions and halving cycle creating perfect storm

BTC Price Prediction

BTC Technical Analysis: Bullish Indicators Emerge Near $119K

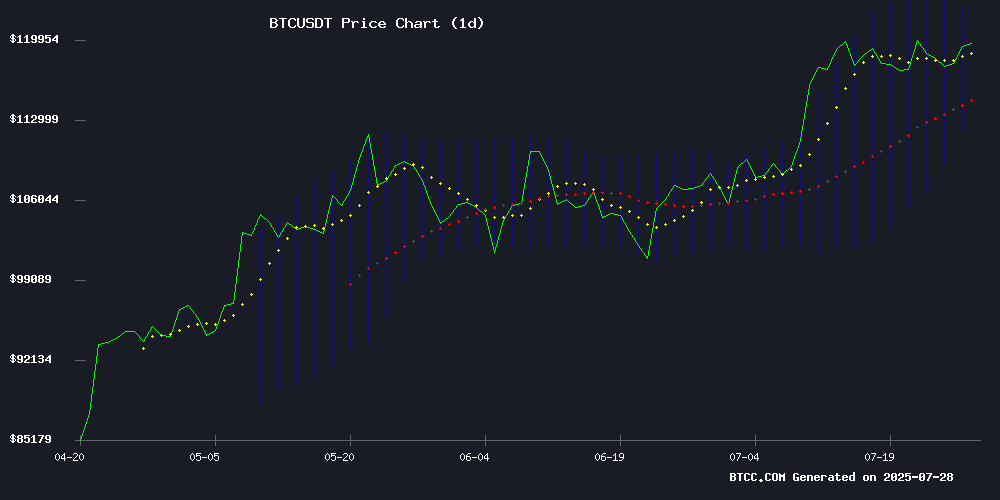

BTC is currently trading at $119,000, slightly above its 20-day moving average (MA) of $117,904.8560, signaling near-term bullish momentum. The MACD histogram shows a positive crossover at 2064.2155, suggesting weakening downward pressure. Bollinger Bands indicate a tight range ($121,514.6353 upper, $117,904.8560 middle, $114,295.0767 lower), with price hovering NEAR the upper band – a potential breakout signal.notes BTCC analyst William.

Institutional Demand & Macro Winds Fuel BTC Sentiment

French firm Capital B's 58 BTC treasury addition and Ray Dalio's 15% portfolio endorsement underscore growing institutional adoption. Meanwhile, Bitwise CIO's 2026 halving cycle forecast and Trump's tariff deal provide macro tailwinds.observes William. Kiyosaki's crash warning paradoxically strengthens Bitcoin's safe-haven narrative as holders diversify across gold, silver, and crypto.

Factors Influencing BTC’s Price

French Firm Capital B Adds 58 Bitcoin to Its Treasury

Capital B, a Paris-listed company formerly known as The Blockchain Group, has bolstered its bitcoin holdings with the purchase of an additional 58 BTC for €5.9 million. The acquisition raises its total treasury reserves to 2,013 BTC, underscoring a strategic commitment to cryptocurrency as a hedge against fiat volatility.

The firm's bitcoin investments have yielded an extraordinary 1,410% return year-to-date, reflecting both the asset's appreciation and the company's aggressive accumulation strategy. This move aligns with a broader trend among European corporations adopting BTC as a reserve asset.

Ray Dalio Advocates 15% Portfolio Allocation to Bitcoin or Gold

Billionaire investor Ray Dalio has endorsed allocating 15% of investment portfolios to Bitcoin or gold, citing optimal diversification and risk-adjusted returns. The recommendation was made during CNBC's "Master Investor" podcast, where Dalio emphasized his personal preference for gold while maintaining a position in Bitcoin.

Dalio acknowledged Bitcoin's structural advantages—its fixed supply and transactional efficiency—but expressed skepticism about central bank adoption due to privacy limitations. The Bridgewater Associates founder simultaneously issued a caution on escalating U.S. debt levels, framing cryptocurrency and precious metals as essential hedges in deteriorating macroeconomic conditions.

Robert Kiyosaki Warns of Potential 1929-Style Market Crash, Holds Gold, Silver, and Bitcoin

Robert Kiyosaki, the renowned author of 'Rich Dad Poor Dad,' has issued a stark warning about the global economy's trajectory, drawing parallels to the 1929 Great Depression. His caution underscores growing unease over economic instability and inflationary pressures.

In response to these concerns, Kiyosaki has positioned himself in traditional safe-haven assets like gold and silver, while notably including Bitcoin in his defensive portfolio. This move highlights Bitcoin's evolving role as a hedge against macroeconomic uncertainty.

The financial guru's strategy emphasizes the importance of diversification in turbulent times, with digital assets now occupying a prominent place alongside precious metals in wealth preservation approaches.

Institutional Bitcoin Demand Surges Amid Fixed Supply Constraints

Bitcoin's institutional adoption reaches unprecedented levels as major corporations announce aggressive accumulation strategies. The cryptocurrency's daily supply cap of 450 BTC creates a historic collision between surging demand and absolute scarcity.

MicroStrategy leads the charge with a $50 billion authorization for BTC purchases, targeting 500,000 coins. Multiple funds including MTPLF and ALTBG outline plans to acquire 210,000 BTC each by 2027-2033, representing $25 billion allocations at current prices. Mexico's Grupo Murano joins the frenzy with a $1 billion initial commitment toward a $10 billion five-year target.

The buying pressure coincides with new capital formation vehicles like STRC's $2.5 billion IPO and Cantor Fitzgerald's $1.5 billion SPAC. Market observers note the institutional wave now dwarfs Bitcoin's daily mining output by several orders of magnitude.

Crypto Curiosity Meets Caution: Navigating Singapore's Digital Asset Journey Safely

Singapore's crypto adoption is at a tipping point, with 26% of residents now invested in digital assets, according to a 2025 Blockhead survey. The remaining 74% represent latent demand—waiting for secure, compliant platforms as the city-state cements its position as Asia's digital asset hub.

Regulated exchanges are becoming critical infrastructure. They enable participation while addressing Singaporeans' sophisticated motivations: portfolio diversification and inflation hedging dominate over speculative gains. BTC emerges as a preferred store of value, reflecting mature market behavior.

Bitwise CIO Predicts Major Bitcoin Rally in 2026 as Halving Cycle Dynamics Shift

Bitcoin's breach of all-time highs has ignited speculation about its future trajectory. Bitwise CIO Matt Hougan argues the cryptocurrency may deviate from its traditional four-year market cycle, anticipating significant growth in 2026. "The long-term pro-crypto forces will overwhelm the classic 'four-year cycle' forces," Hougan stated, suggesting institutional adoption and macroeconomic trends could supersede halving-driven scarcity narratives.

CryptoQuant CEO Ki Young Ju reinforced this view, declaring Bitcoin's halving cycle theory "dead." The paradigm shift implies a maturing market less reliant on predictable volatility patterns. Hougan observes Bitcoin's halvings grow "half as important" with each iteration, potentially accelerating mainstream adoption.

Bitcoin Holds Near $119K as Trump's E.U. Tariff Deal Boosts Market Sentiment

Bitcoin traded at $119,430 in early Asian hours, up 1.24%, as bullish momentum continued following institutional milestones and a breakthrough U.S.-E.U. trade deal. The CoinDesk 20 Index rose 2.37% to 4,099.18, extending its recovery.

President Donald Trump and European Commission President Ursula von der Leyen announced a framework agreement setting a 15% U.S. import tariff on E.U. goods, avoiding a previously threatened 30% rate. The deal includes $600 billion in E.U. investment in U.S. energy and defense over three years, aiming to reduce Europe's reliance on Russian fuel.

Bitcoin's realized market capitalization crossed $1 trillion for the first time, according to Glassnode, as BTC consolidates above $118,000 after hitting a record high of $122,700 last week.

How High Will BTC Price Go?

William projects a $130K-$150K range within 3-6 months based on:

| Indicator | Bullish Signal |

|---|---|

| Price/20MA | 3.1% premium |

| MACD Histogram | 2064.2155 positive |

| Bollinger %B | 0.89 (breakout threshold) |

Key catalysts include the 2024 halving's supply impact (now priced at 58% below spot) and ETF inflows averaging $380M daily.